Renewable Environmental Investments

Right now, a renewable revolution is taking place.

This change will alter the way we produce and consume resources.

This has triggered an unprecedented opportunity for innovators, entrepreneurs, investors and local communities combined.

Investment Approach

Our Approach

Formally RBE, Renewable Environmental Investments Ltd (REIL) are a private investment company.

Based out of Richmond Yorkshire, Darlington and London, we invest private capital and provide hands-on support to businesses which tackle the challenges we face as a society today. Providing energy security, combating climate change, reducing waste, improving technology efficiencies, bringing down costs to consumers and ensuring a planet for future generations.

Our founders have over 40-years combined experience operating in the renewables and environmental sectors, they are serial entrepreneurs having created hundreds of jobs both locally and internationally.

Today REIL has over £150m of assets under management across ten businesses operating in waste recycling, renewable energy, and technology development sectors.

Sectors

Solar

Wind

Battery Storage

Electric Vehicles

Waste Recycling

Water & Drainage

Why We Do It

2022 Europe was facing an energy crisis, with spiralling costs of importing gas and commodity pricing reaching record highs due to global conflicts. Domestic production is essential for both power generation and recovery of rare earth materials.

Our Team

James Ritchie

CEO & Founder

Jack Simpson

COO & Investor

Ian Bainbridge

Director & Investor

11-years as a corporate lawyer with extensive experience in M&A, group reorganisations, shareholder and joint venture agreements. Daniel is currently a Partner at Knights plc.

Award winning financial professional with over 14-years experience through Ernst & Young & Anderson Barrowcliff. James is a chartered accountant with multiple degrees across finance and law.

Daniel Flounders, LLB

Legal Counsel

James Dale, FCCA

Corporate Finance & Accounts

Our Portfolio

REIL Renewables

REIL Renewables develop and invest in all renewables technology, including wind, solar and battery energy storage assets within the UK, to create a sustainable renewable energy future for all.

Harmony Energy

Advanced Electric Machines

tepeo

REIL Innovations

REIL Innovations looks for technology start-ups with commercial opportunities in Renewables and Environmental businesses.

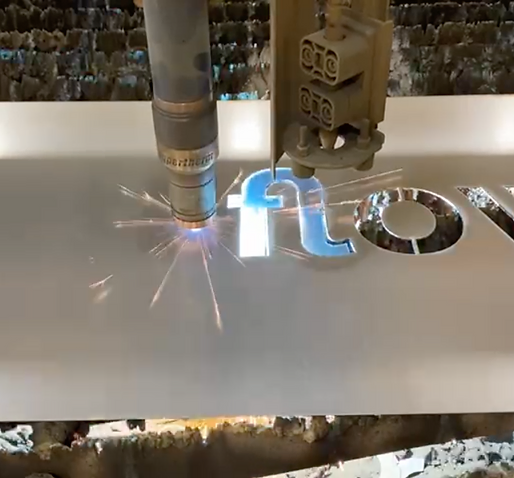

Innoflow

Innoflow are an innovative solutions provider to the water and wastewater industry.

Harmony Income Trust

GAP Group

Plasterboard Recycling Group

REIL Recycling (part of Renewable Environmental Investments Ltd) has the pleasure of investing in Plasterboard Recycling Group Ltd (PRG), which is planning major national expansion.